the signal lab

Civic Content Infrastructure for 2026 midterms

Verified political content in 2-4 hours instead of 24-48.

We’re operational, not theoretical. $7.1B market. Perfect timing.

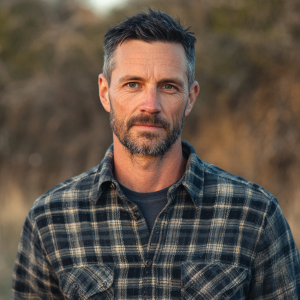

See The Product Working: IZZY TORRES - Communications director

There has been a seismic shift in how information is distributed today.

In 2016, one person could manage two platforms.

In 2026, that same person faces 12+ platforms, 4+ content formats, and stories that go viral in minutes.

The gap isn't closing. It's accelerating.

Two Distinct Problems, One Platform

Problem 1 - Political Campaigns:

Campaigns lose elections because attacks spread faster than they can respond. They need rapid-response content that matches the speed of social media.

Problem 2 - Civic Organizations:

Education associations struggle to educate millions of members before policy moves past them. They need fast, verified member communications at scale.

We're Operational, Not Theoretical

Proven technology. Real content. Ready to scale.

- Production Velocity

- 20 podcasts in 30 days

- Multi-voice formats (4-5 per episode)

- jwstud.io proof

- "Validate capacity for campaigh volume"

- Political Content

- 15 Rapid Signal examples

- Immigration, tariffs, vaccines

- Single-voice, dialogue, video formats

- "Proves we can handle controversial topics"

- Persona Library

- 300+ personas built

- $200K+ invested

- 6-12 month competitive lead

- All CopySight protected

the signal lab Personas

We have personas for every voter segment...

Our Persona Library: 300+ Characters Across 6 Strategic Demographics

Each demographic segment represents distinct voter profiles, regional characteristics, and communication styles. Below are examples from each of our four core segments:

– HEARTLAND (50 personas): Rural/suburban, traditional values, ages 35-65

“Serves: 40% of US voters | Use cases: Rural campaigns, suburban outreach, agricultural policy”

– VIBE (60 personas): Urban/suburban, progressive, ages 25-45

“Serves: 35% of US voters | Use cases: Urban campaigns, progressive messaging, climate/tech policy”

– PRISM (50 personas): Diverse communities, multicultural, all ages

“Serves: 15% of US voters | Use cases: Diverse communities, multicultural outreach, immigrant issues”

– NEXT (40 personas): Young voters, digital-native, ages 18-30

“Serves: 10% of US voters | Use cases: Youth mobilization, education debt, digital-first campaigns”

This represents 6-12 months of development work and $200K-400K in infrastructure investment that competitors don’t have. All CopySight protected.

Jewish-American bakery barista/part-time student

Rural Republican Special Ed Parent

Palestinian-American pre-med student

Queer Environmental Scientist & Climate Truth Advocate

Veteran & Mental Health Truth Teller

Podcast producer/DJ

Community Storyteller & Crime Perception Fact Checker

Mexican-American, community college journalism student

Nonbinary Musician & Gender-Affirming Care Truth Teller

Healthcare Administrator & Medical System Truth Teller

Community arts fellow/youth mentor

Post-Grad & Economic Realist

These 5 demographic segments allow us to serve any campaign or organization:

✓ Congressional campaigns: Mix HEARTLAND + VIBE personas for swing districts

✓ Urban mayoral races: Focus on VIBE + PRISM personas

✓ Rural state legislature: Deploy HEARTLAND personas exclusively

✓ Youth mobilization: Activate NEXT demographic

✓ Education associations: Teacher personas from HEARTLAND + new teacher voices from NEXT

One persona library. Infinite campaign applications.

Our Persona Library: Interactive Demos

15 clickable examples representing different demographics, regions, and voter profiles. Each features an AI-generated voice and a corresponding visual. This is what campaigns and education associations get — tailored to their specific audience segments.

Click any persona to hear the AI voice and see the format.

Ethan Carver

Springfield, IL • Retired Police Sergeant

Marisol Vega (she/her)

Phoenix, AZ • Immigration Advocate

Harold “Skip” Lawson

Decatur, IL • Retired Principal

Rosa Alvarez

Elgin, IL • ESL Coordinator & Community Liaison

ENGLISH

español

Dr. Lila Foster

Champaign, IL • Education Policy Professor

ENGLISH

Polish

Anna Volkov

Skokie, IL • Special Education Teacher

ENGLISH

Russian

JORDAN “JORDY” MARTINEZ

Chicago, IL • Podcast Producer/DJ

Mark Whitfield

Quincy, IL • Retired Trooper

ZORA MITCHELL

New Orleans, LA • Community Arts Fellow

Tyrone Davis & Elana Rossi

National Guard in U.S. Cities

Jack Reilly & Dr. Arjun Patel

Grocery Inflation Explained

Miguel Santiago & Elana Rossi

Redistricting & Your Vote

Rapid Signal Persona System

People trust people like them.

Personas map to topic × community — nurse/health, pastor/safety, veteran/civic duty, teacher/education. Voters hear from someone who sounds like them, grounded in verified facts, not a generic narrator.

AI-Narrated Formats. Built for Speed.

Tap to play with sound.

Mark Whitfield and Maya Thompson deliver Rapid Signal fact-checks — two perspectives, two formats. Same mission: real voices turning facts into clarity.

Optimized for Reels (9:16) and tablet view (16:9) — both orientations side by side.

Rapid Signal clips are optimized for Reels, Shorts, and TikTok — 30-45-60 seconds of verified truth that feels native.

In every community, someone you trust is already telling the truth. We just make sure it’s heard.

💙 Ethan Carver on Bluesky ✝️ Pastor Elijah Brooks on Instagram 🔧 Miguel Santiago on TikTok

Why Rapid Signal is Different: Competitive Analysis

NO DIRECT COMPETITORS IN RAPID-RESPONSE AI CONTENT

We’re the only platform that produces verified, persona-driven rapid-response media across channels with this speed, volume, and cost-efficiency.

WHAT EXISTS (AND WHY IT'S NOT COMPETITIVE):

- QUILLER (AI Messaging Platform)

- Writes text only

- No video or audio production

- No fact-checking

- No rapid-response capability

- No persona targeting

- Useful tool. Entirely different category. Text generation ≠ media production.

- ARENA (Talent + Training)

- Trains human staff

- Places digital and comms talent

- Does not create content

- Does not automate anything

- No rapid-response capability

- People placement. We're a scalable media engine.

- TRADITIONAL DIGITAL AGENCIES

- Human bottlenecks (24-48 hour response)

- Studio + editors + crew required

- Would cost $100K-$250K/month to match our output

- Not built for algorithm-driven short-form media cycles

- We replace what humans simply cannot do fast enough.

- OUR COMPETITIVE MOAT:

- 130+ Persona Library ($200K-400K, 6-12 months competitors don't have)

- Operational Product (we're ready, they're building)

- Production Velocity (20 in 30 days proven)

- Multi-format Capability (audio, video, dialogue all validated)

- Speed Advantage (2-4 hours vs 24-48 hours)

- Cost Advantage (5-10x cheaper per piece)

- BARRIER TO ENTRY:

- High. Building comparable persona library requires:

- 6-12 months development time

- $200K-400K investment

- Voice synthesis technology licensing

- CopySight IP protection

- Operational expertise (we've proven it works)

- FUTURE COMPETITION:

- We expect competitors within 12-18 months. But by then we'll have:

- 50+ campaign testimonials

- 10-15 education association clients

- 1,000+ pieces produced

- Brand recognition in political space

- Network effects from NEA → state affiliates → campaigns

Speed & Scale: Our Core Advantage

How a rumor becomes a verified response - in under 4 hours.

Each morning, Rapid Signal scans community feeds and alerts for narrative surges. When a claim spikes, our team verifies the facts, scripts explainer content, and generates persona-delivered clips – ready for TikTok, Reels, Shorts, X, or podcasts within 2-4 hours.

RESPONSE TIME

Industry standard: 24-48 hours

Rapid Signal: 2-4 hours

Crisis situations: 1 hour possible

DISTRIBUTION-READY FORMATS

Video: TikTok, Instagram Reels, YouTube Shorts

Audio: Podcast, radio, social media

Multi-platform: Single content piece rendered for all channels

PRODUCTION CAPACITY

240-280 pieces per 8-week campaign cycle (validated)

150-200 pieces per 3-month legislative session

Can scale to 30-40 simultaneous clients with current infrastructure

0-60 clients at peak (with $500K funding)

PROOF

20 podcasts in 30 days demonstrates we can handle campaign intensity.

The 2026 Midterm Opportunity

Perfect convergence: Operational product + massive election cycle + ready buyers

- Market Size: $7.1B-7.9B TAM

- $7.1B - 7.9B Addressable Market

-

Political: $2.1B

Congressional, gubernatorial, state legislature campaigns. 2026 midterms: 435 House seats + 33-34 Senate seats + 36 gubernatorial races. -

Education Associations: $75M-200M

Teachers unions and education advocacy. Year-round revenue (not seasonal). NEA (3M members) + 50 state affiliates + other unions. - Civic & Advocacy: $4.6BIssue campaigns, ballot initiatives, labor unions, nonprofit advocacy organizations.

- Why Perfect Timing

- 2026 Midterms = Biggest Cycle in 2 Years Campaigns are planning budgets RIGHT NOW (Nov-Dec 2025) for primary season starting Q1 2026.

- We're Operational While Competitors Build 130+ personas complete. Technology proven. 535+ pieces produced. Can start delivering January 1.

-

Market Validation

- NEA meetings scheduled (December 2025, 3M members)

- IEA meetings scheduled (December 2025, 135K members)

- Education = year-round revenue stream (smooths political seasonality) - First-Mover Advantage 6-12 month lead on persona development. No competitor has operational rapid-response AI content infrastructure.

Why 2026 is Perfect Timing

- MARKET OPPORTUNITY

- All 435 House seats up for election

- 36 gubernatorial races

- 33-34 Senate seats

- Thousands of state/local races

- $2.1B in political spending

- OPERATIONAL ADVANTAGE

- We're ready to ship January 1, 2026

- Competitors are pre-product (still building)

- 6-12 month lead on persona development

- Technology proven (535+ pieces produced)

- BUYER VALIDATION

-

NEA meetings scheduled

(Conversation ongoing, 3M members) -

IEA meetings scheduled

(Waiting executive approval, 135K members) -

Education = year-round revenue

(smooths political seasonality)

CAMPAIGNS ARE PLANNING BUDGETS RIGHT NOW

Q4 2025 is when 2026 campaigns finalize vendors for primary season. We’re catching them at perfect decision-making moment.

The Product: Rapid Signal Content Infrastructure

We produce verified political content in 2-4 hours using AI personas with emotional intelligence.

Formats:

– Audio-only (podcast, radio, social)

– Talking-head video (TikTok, Reels, YouTube Shorts)

– Multi-voice dialogues (debates, discussions, Q&A)

Speed: 2-4 hours (vs industry standard 24-48 hours)

Cost: $125-300 per piece (vs $500-2,000 traditional)

Quality: Distribution-ready, fact-verified, emotionally resonant

OUTPUT CAPACITY:

– 240-280 pieces per 8-week campaign cycle

– 150-200 pieces per 3-month legislative session

– Can handle 30-40 simultaneous clients at scale

Traction: Pre-Revenue, Post-Product

We're not pre-product. We're operational and proving market validation.

Content Produced

- 400+ Total Pieces

- 50+ podcasts (JourneyWise Studios)

- 50 political clips (RAPID SIGNAL)

- 300+ other civic content

Infrastructure Built

- 250+ Persona Library

- HEARTLAND (50 personas)

- VIBE (40 personas)

- PRISM (40 personas)

- NEXT (30 personas)

- UNITY IEa (30 personas)

- ACCESS NEA (30 Personas)

- +30 JourneyWise personas

- $200K-400K Invested

- All CopySight protected. Competitors need 6-12 months to replicate.

Market Validation

- December 2025 Meetings

- NEA (National Education Association) 3,000,000 members

- IEA (Illinois Education Association) 135,000 members

- Education Associations = Game Changer

- Year-round revenue (not seasonal like campaigns). Higher LTV. Network effects (NEA → 50 state affiliates).

Early pilot modeling suggests misinformation decays faster when a verified response is active — often within the first 24–48 hours.

Every metric answers one question: did the right information reach the right people fast enough?

Quality & Verification Standards

Every piece of content goes through multi-stage verification before distribution.

FACT-CHECKING INFRASTRUCTURE

API access: AP FactCheck, Reuters, PolitiFact

Source verification: Minimum 2 independent sources

Real-time data: GovTrack, FEC, official government databases

AI LABELING & TRANSPARENCY

All content clearly labeled as AI-generated. No attempt to deceive.

Transparency builds trust with voters and protects clients from backlash.

TECHNOLOGY PARTNERS

Hume.ai: Emotional intelligence voice synthesis

OpenAI: Content generation with factual grounding

CopySight: IP protection for persona library

AP/Reuters/PolitiFact: Fact verification APIs

EDITORIAL OVERSIGHT

Human review at key checkpoints. AI generates content, humans approve accuracy and messaging alignment.

This infrastructure addresses investor concern: “Is this misinformation creation?” Answer: No. It’s rapid response with verification built in.

"In every community, someone you trust is already telling the truth. We just make sure it’s heard." -Jordan Lee

The $500K Pre-Seed Round

Q1 2026 Target Close

Funding to scale operational product into two simultaneous markets: 2026 midterm campaigns (seasonal peaks) + education associations (year-round revenue).

Use of Funds

Sales & Go-to-Market: $150K

- Sales hire (congressional campaign outreach)

- Education association business development

- Pilot execution and client success

Production & Operations: $180K

- Scale capacity (30-40 simultaneous campaigns)

- Quality assurance team

- Handle Q1 2026 pilot volume

Technology & Infrastructure: $80K

- Platform improvements and automation

- Additional persona development

- API integrations (fact-checking, distribution)

Working Capital: $90K

- Cash runway through Q3 2026

- Bridge to revenue generation

Milestones

Q1 2026

- $300-500K revenue (10-15 clients: IEA + 5-10 campaigns + 2-3 state affiliates)

Q2 2026

- $1M+ cumulative revenue (25-30 active clients, pilot conversions + referrals)

H2 2026

- $2-3M revenue (midterm peak: 40-50 campaigns, NEA + 8-10 state affiliates)

December 2026

- $3-5M ARR run rate, proven unit economics, Series A ready

Unit Economics

Campaign Clients:

- Pilot: $35K (8 weeks)

- Full cycle: $75K-100K

- Gross margin: 40-55%

Education Associations:

- State affiliate: $15K/month ($180K annual)

- NEA-scale: $50K/month ($600K annual)

- Gross margin: 45-60%

Blended CLTV:CAC: 5-8x

Investor FAQ

300+ persona library represents 6-12 months and $200K-400K that competitors don’t have. All CopySight protected. Operational product while others are pre-product. First-mover in rapid-response political AI content.

Technology advantage: Multi-voice capability proven (20 podcasts, 4-5 voices each). Speed advantage: 2-4 hours vs industry standard 24-48 hours.

Campaign clients: $35K-100K per client, 40-55% gross margins. CAC: $3K-5K (direct sales + referrals).

Education associations: $180K-600K annual retainers, 45-60% gross margins. Higher LTV (multi-year contracts vs single campaigns).

Blended CLTV:CAC ratio: 5-8x at maturity.

Speed: Current industry standard is 24-48 hours to respond to attacks. We deliver in 2-4 hours. By the time competitors respond, narrative is already set.

Cost: Traditional agencies charge $500-2,000 per piece with 24-48 hour turnaround. We’re $125-300 per piece with 2-4 hour turnaround. 5-10x cheaper.

Proof: Not theoretical. 15 political content examples they can watch/listen to. Controversy-tested (immigration, vaccines). Multiple formats (audio, dialogue, video).

Speed: Policy moves fast. When legislation drops or misinformation spreads, associations need to educate 100K-500K members within hours, not days. Traditional comms can’t keep pace.

Cost: Hiring video teams or agencies costs $50K-150K per month. We’re $15K-50K per month and 10x faster.

Proof: IEA (135K members) is piloting December 2025. NEA (3.1M members) meetings scheduled. We’ve already produced 20 podcast episodes in 30 days demonstrating multi-voice capability.

Dual-market launch de-risks execution. If campaigns are slow to buy (political risk), education associations provide stable revenue. If associations need longer sales cycles, campaigns provide fast cash flow. Each market validates the other.

Phase 1 (Q1 2026): IEA pilot + 5-10 congressional campaign pilots. Prove model, generate testimonials.

Phase 2 (Q2 2026): IEA testimonial → NEA contract + more state affiliates. Campaign referrals + direct outreach to gubernatorial races.

Phase 3 (Q3-Q4 2026): Scale to 40-50 campaigns (midterm peak) + NEA + 10-15 state affiliates. Network effects kick in.

Sales model: Direct sales (campaigns need rapid response, education associations value speed). Low CAC, high conversion on demos.

Primary risk: Go-to-market execution (we’re pre-revenue). Technology and product are proven.

Mitigation:

– December 2025 meetings with 3M+ member organizations (IEA, NEA)

– Q1 2026 pilots validate sales process and unit economics

– Dual markets (political + education) diversify revenue

– First-mover advantage (6-12 month persona library lead)

– 2026 midterms timing = natural market urgency

Acquisition targets:

– Political tech platforms (NGP VAN, ActBlue, Campaign Deputy)

– Communications agencies (adding AI rapid-response capability)

– Civic tech companies (Democracy Works, BallotReady)

– Education tech platforms (adding association communications)

Public market potential: At scale ($50M+ ARR), civic infrastructure platforms command 8-12x revenue multiples.

Timeline: Typical path is Series A (2027), Series B (2028), exit (2029-2031). But strategic acquisition possible earlier if right buyer sees value.

Join The Round

We’re raising $500K to scale into the 2026 midterms.

Operational product. Perfect timing. Ready buyers.

Target close: Q2 2026.